Navigating the Future Price Landscape Of Crypto

In recent years, the world of cryptocurrency has experienced unprecedented growth and volatility, captivating both seasoned investors and curious newcomers alike. As we step into the future, the allure of digital assets continues to grow, fueled by technological advancements, evolving market dynamics, and a quest for financial innovation. In this article, we’ll explore the current state of the crypto market and speculate on its future price trends, all while considering the factors that contribute to this ever-evolving landscape.

The Current Crypto Landscape:

Before we delve into the future, let’s take a snapshot of the present. Bitcoin, the pioneer and poster child of cryptocurrencies, continues to dominate the market, but its supremacy is being challenged by a myriad of altcoins and blockchain projects. Ethereum, Binance Coin, and Solana are just a few of the contenders vying for a piece of the digital pie.

Price Volatility:

One undeniable characteristic of the cryptocurrency market is its volatility. Prices can swing wildly within short time frames, leading to both exhilarating gains and gut-wrenching losses. The graph above illustrates the price volatility of Bitcoin over the past years, showcasing the market’s inherent unpredictability.

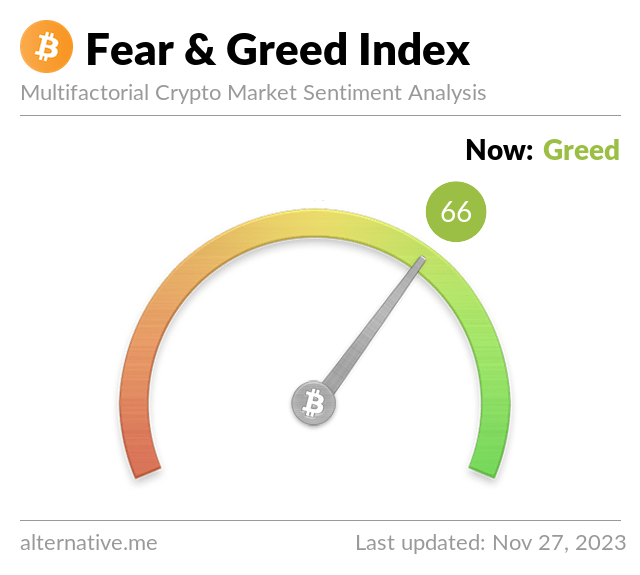

Market Sentiment:

Crypto prices are not solely determined by market fundamentals; sentiment plays a crucial role. News, social media trends, and regulatory developments can swiftly sway investor sentiment, leading to rapid price movements. Analyzing sentiment indicators, such as the Fear and Greed Index, can provide insights into the prevailing mood of the market.

Technological Developments:

The crypto space is dynamic, with continuous technological innovations shaping its future. From decentralized finance (DeFi) platforms to non-fungible tokens (NFTs), the ecosystem is expanding at a remarkable pace. These advancements not only enhance the utility of cryptocurrencies but also influence their market valuations.

Regulatory Impact:

Government regulations play a pivotal role in the crypto market’s trajectory. Clarity or ambiguity regarding the legal status of cryptocurrencies can significantly impact investor confidence. Regulatory developments can either propel the market to new heights or trigger selloffs, depending on the nature of the announcements.

Predicting the Future:

#Bitcoin: It’s always boring before it gets interesting! pic.twitter.com/pvC11WnFLZ— MMCrypto (@MMCrypto) November 27, 2023

While predicting the exact future prices of cryptocurrencies is a daunting task, analyzing trends and understanding the factors that influence the market can provide valuable insights. Market analysts often use technical analysis, fundamental analysis, and macroeconomic factors to make informed predictions.

Conclusion:

The crypto market’s future remains uncertain, but one thing is clear – it will continue to evolve and captivate the financial world. As technological advancements, regulatory developments, and market dynamics shape the landscape, investors must stay informed and adapt to the ever-changing crypto environment. Whether you’re a seasoned trader or a curious observer, the future of crypto promises excitement, challenges, and opportunities for all.